Rising Cost to Stand Out

6

Circularity in the Growth Story

We believe D2C brands need to recognize their phase of journey in order to evaluate

the relevance and adequacy of their growth strategy initiatives. An outsized initiative

for instance may too costly or may be underwhelming.

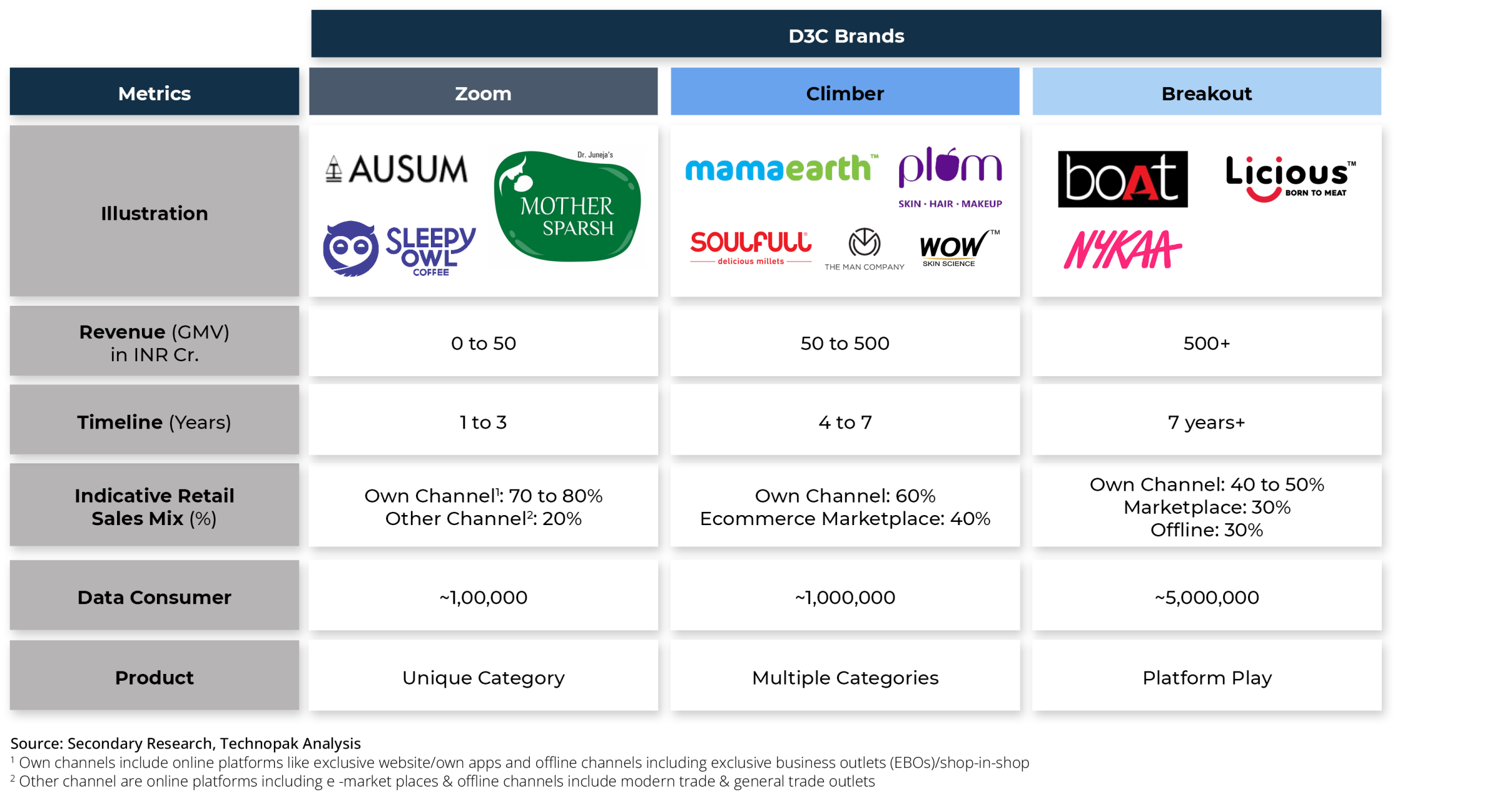

We believe it is crucial for a D2C brand to sustain its modular character in order to significantly increase its chances to stay the course. D2C brand’s evolution in India can be signified by three phases of growth - Zoom, Climber and Breakout. Each of these phases reflects the D2C play with a distinct set of business outcomes in terms of scale (sales), access to consumers, route to market (retail channels) and product offering and each phase demands different set of leadership skills, and capital allocation priorities. We believe a dispassionate assessment on this framework imbibes both the windshield and the rear view mirror perspectives needed for the growth journey. For instance, the framework allows the D2C play to create a dashboard of lead indicators that help to evaluate the nature of growth and to determine triggers for changing gears with timely calls on capacity building, burn rates, expansion, mergers and even closures.

For the D2C Playbook

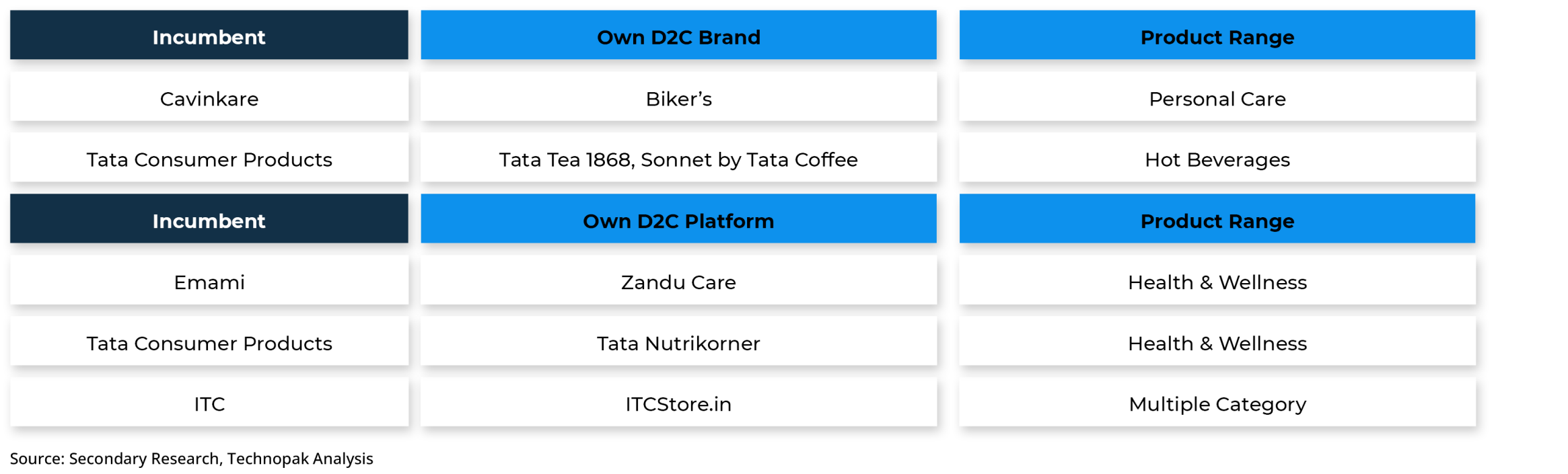

Incumbents have accelerated their plans through brown field route (acquiring businesses) as a tool to gain rapid access in new niches and evolving consumer preferences.

Two approaches emerge as incumbents

put in place a strategy to leverage

the D2C brand space

It will be misleading to interpret that the projected growth of the D2C business will be synonymous with start-ups achieving scale and that all the incremental growth of the D2C opportunity will fall in their kitty.

Inarguably, start-ups have demonstrated the potential of D2C play, they have disrupted consumer sectors like FMCG, Home, Consumer Electronics with new benchmarks and rules of conducting business. In doing so, incumbent brands have realized these virtues of the D2C play and have rapidly activated their plans to imbibe this new theme as a critical growth driver.

the D2C Playbook

Corporate Identification Number:

U74140DL1994PTC61818

Vaibhav Tembulkar

Subject Matter Expert

Neha Jain

Manager

neha.jain@technopak.com

Manish Chandra

Manager

manish.chandra@technopak.com

Ankur Bisen

Senior Partner & Head of Retail

ankur.bisen@technopak.com

Authors of the Report

Incumbents are also showing appetite to incubate D2C businesses internally. Such green field initiatives include new D2C brands and broader E-commerce platform. These initiatives allow incumbents to pace their D2C journey at will and give them the elbow room to manage stakeholders’ expectations like capital allocation decisions for the journey. We also believe that more importantly, these initiatives also serve as a catalyst towards capacity building and wider organizational transformation to prepare and seize the D2C opportunity.

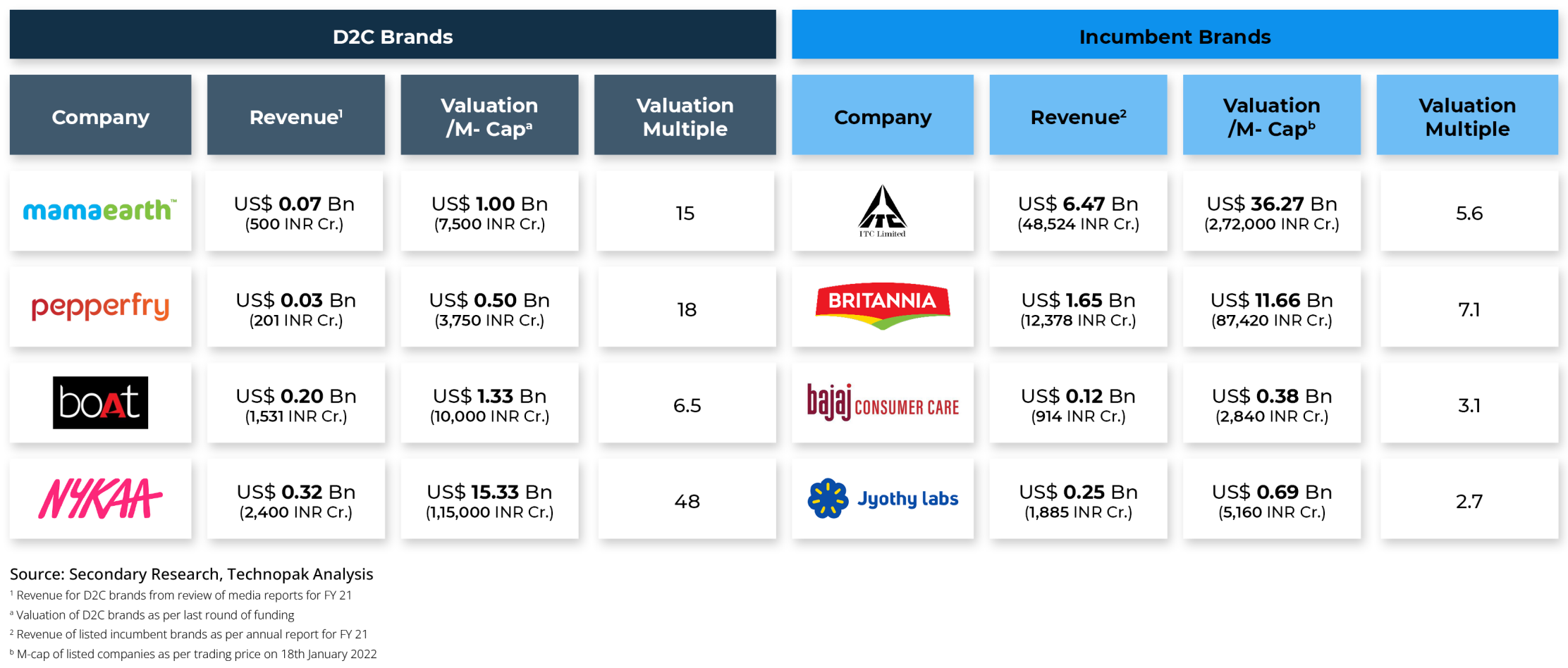

We believe these three reasons act as strong triggers for investors and venture capital to evaluate D2C businesses to use different metric and framework than perhaps the factors they would deploy for incumbent brands in the same space. The myriad possibilities of mining of data on consumer, the digital retail infrastructure involving apps and websites attracting repeat traffic in large numbers and the use of digital marketing tools that can be measured on a real time basis for ROI entice investors to view D2C on what they can be rather than what they currently are.

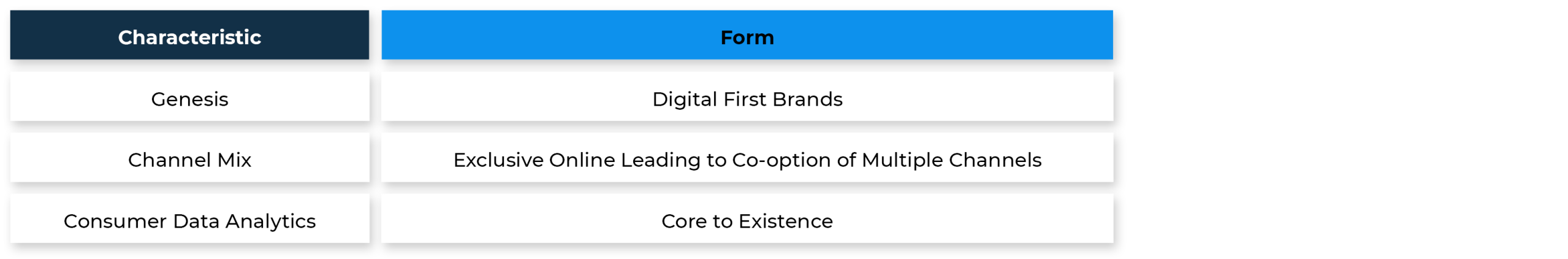

Relentless focus of D2C brands on analytics and consumer data makes them stand out from the incumbents. This is reflected in the share of their operating costs on technology and data analytics and extent of deployment of digital tools to collect consumer insights. This enablement is done by D2C brands through own websites, stores, and apps etc. that provide them with rich data on consumer that is used for product development, sales, and cost optimization.

3

Focus of D2C Brands on Analytics and Consumer Data

The share of sales that D2C brands derive from multiple retailing channels involving own websites, marketplace listings and brick retail. On this count they may appear to be more like traditional brands that rely on a multi-channel retail structure. However, here too a fine difference exists in that most D2C brands started their journey by activating a direct-to-consumer retail outreach like an own website (Licious, Pepperfry) or own stores (Nykaa) rather than to rely on the existing third-party retailing routes to market.

2

Direct-to Consumer Retail Outreach

Outsized role of digital assets (websites, apps) and tools (social media, digital marketing, influencers) in direct consumer outreach for these D2C brands stands out compared to that of existing Direct to Selling consumer models. Our research suggests that the role of digital leverage for D2C is even greater than of many incumbent consumer brands.

for D2C Brands

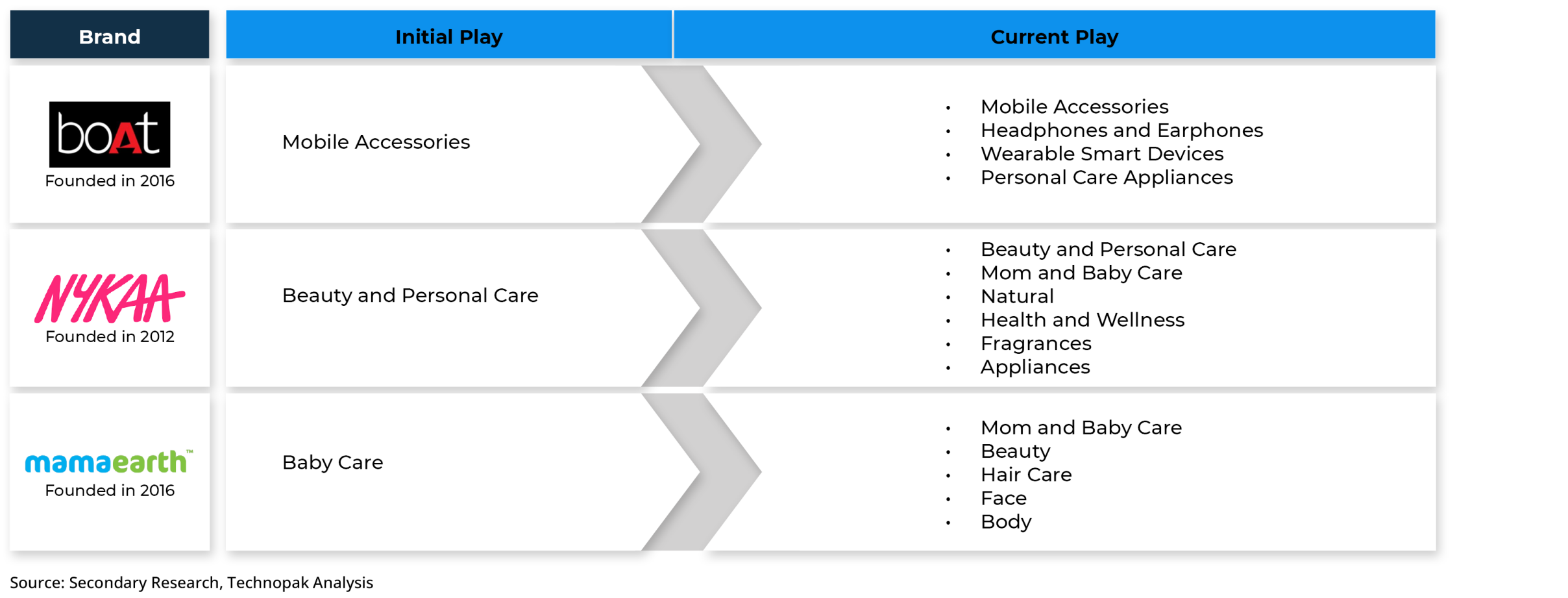

Undoubtedly, strong product associations defined the early growth of D2C brands. Their successes exploited niches and in a very short span have shown that they are capable to expand their customer experience from a small niche of a product or product category to an expanded category play encompassing an ecosystem of products and SKUs. This can be in line with growth aspirations and need to overcome limitations of a single product category.

Breaking scale requires expansive view of to the addressable market opportunity. A sharp focus in the launch phase helps the D2C brands catch the imagination of consumer but it is the expanded view that D2C brands are increasingly realising for sustained growth.

1

Outsized Role

of Digital Assets and Tools

5

6

5

4

3

2

1

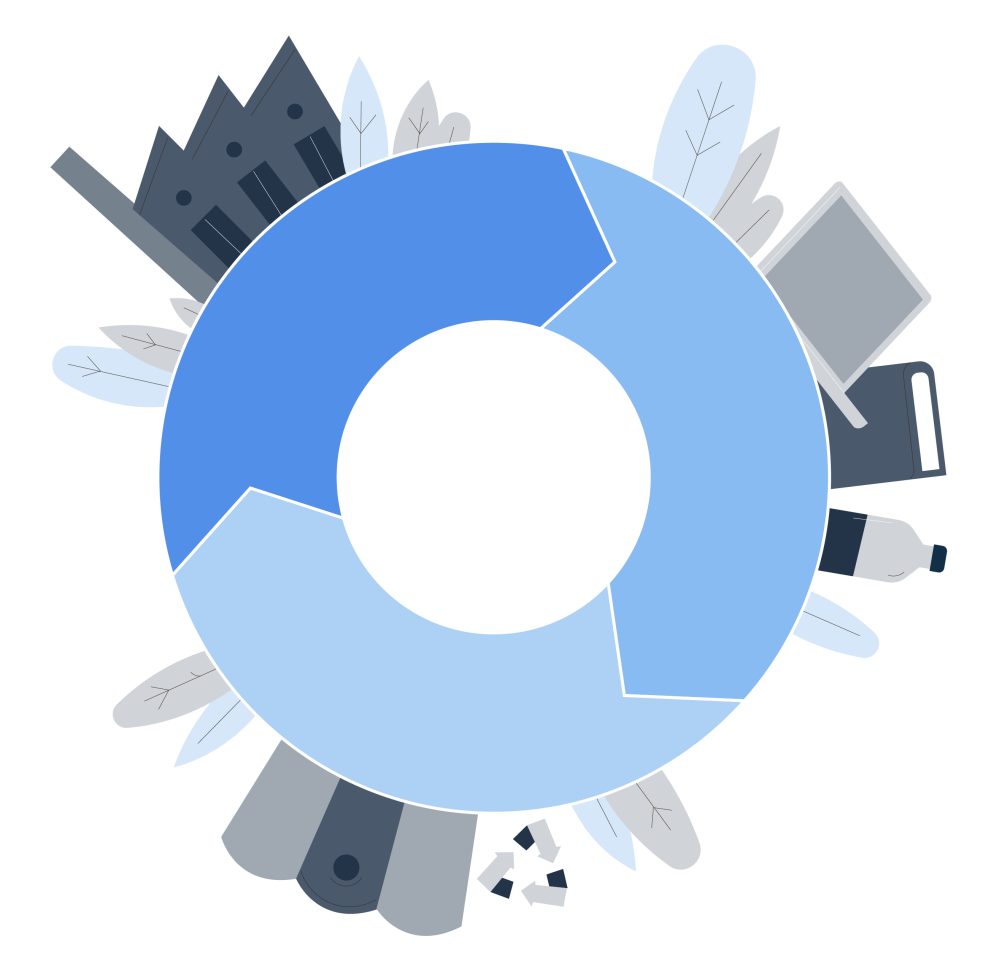

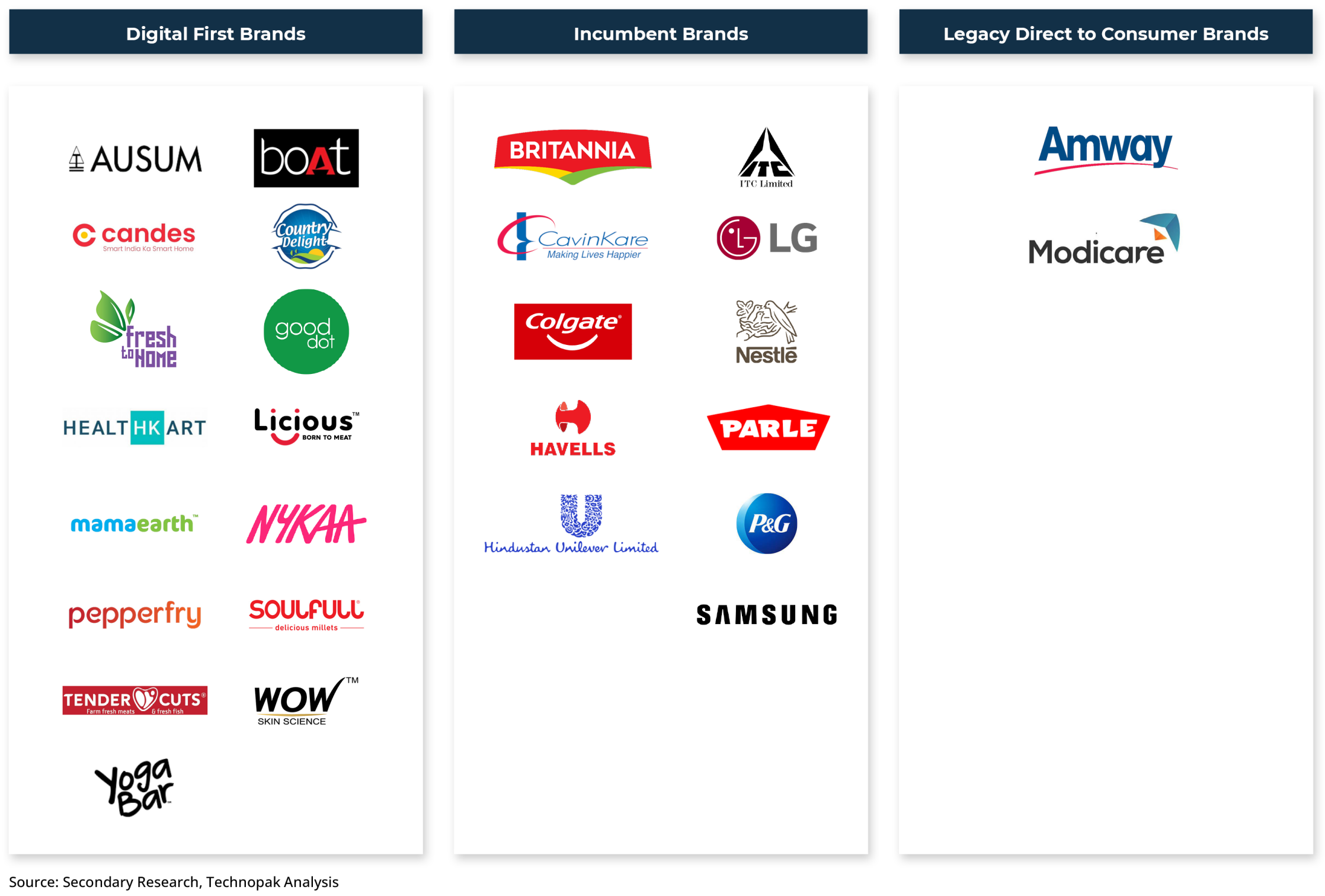

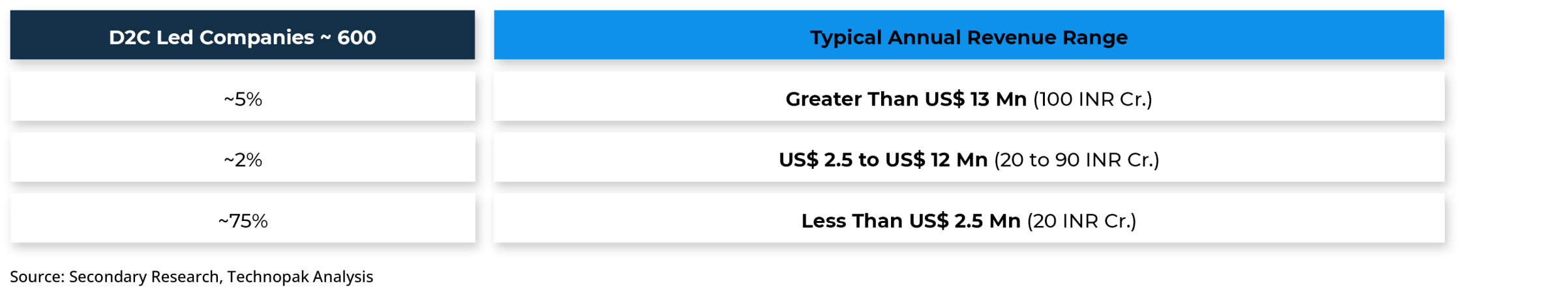

Exhibit 11 - Market Structure of the D2C Play in India

Proliferation of the D2C surge should also be read as a proof of reduced entry barriers in one of the most heterogenous and complex retailing environments in the world. With an ecosystem of plug and play facilities and services and a positive disposition of private capital (PEs and VCs) towards D2C, today 600+ plus brands are vying for their share of customer attention and scale. This is a double-edged sword that presents ease of entry on one end and rising cost to compete on the other. Few of these brands have succeeded to branch out and are now more incumbent than start-in in character viz. Pepperfry, Licious, BoAT, Nykaa. Incumbents like Tata Consumer, Marico, Emami, Cavin Kare and ITC have amplified their D2C focus exercising all options on the table. We believe this context is indicative of rising competitive intensity that will increasingly put the pressure on the cost to compete thereby making many D2C starts more prone to vulnerability than to the probability of a break-out.

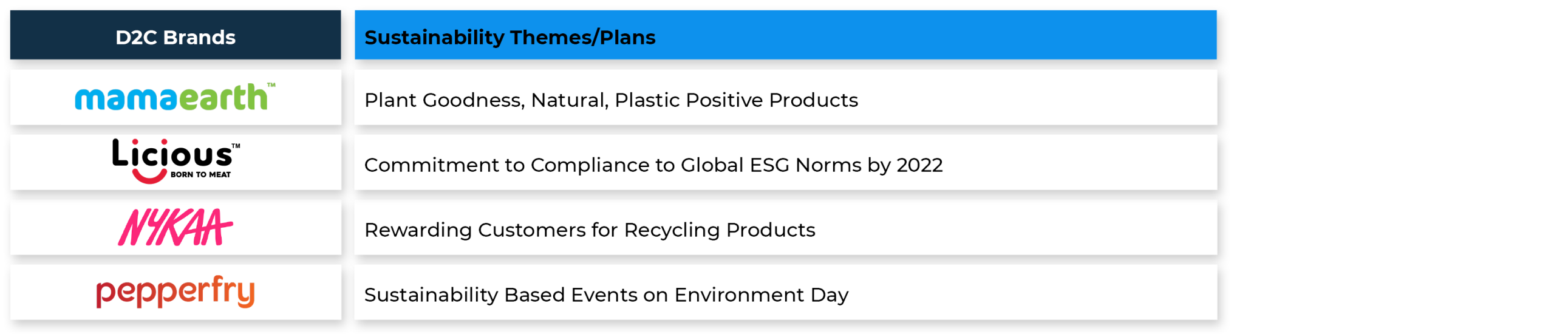

Exhibit 14 - D2C Brands and Sustainability Themes

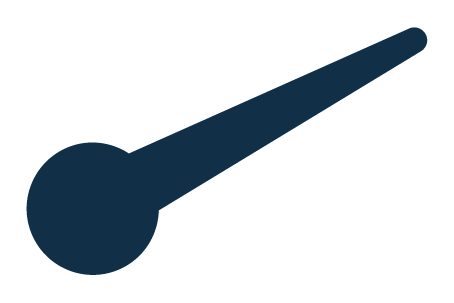

Exhibit 12 - D2C Brands Through Different Phases

Hardwire Sustainability and Circularity in the Growth Story

4

3

2

1

3

Focus of D2C Brands on Analytics and Consumer Data

2

Direct-to Consumer Retail Outreach

1

Outsized Role

of Digital Assets and Tools

Juggle between the

Windshield and the Rear-View

2

2

1

1

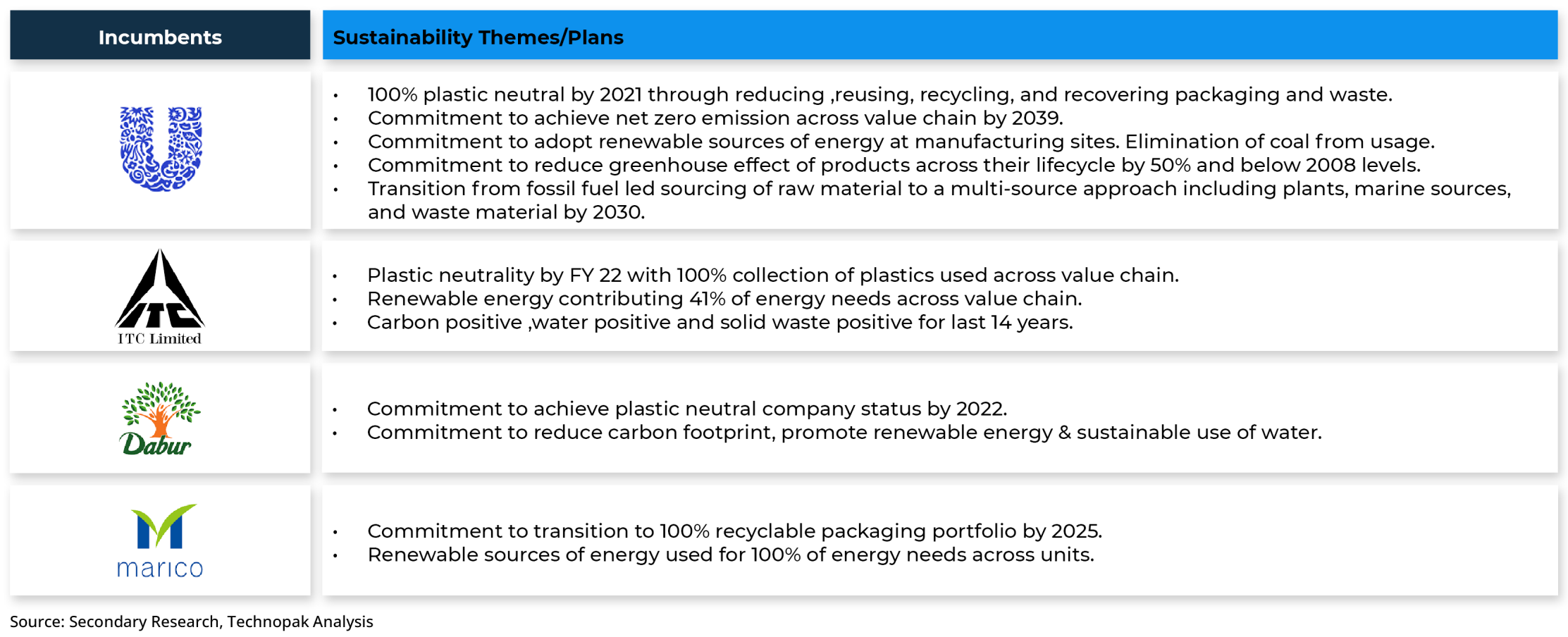

Exhibit 13 - Incumbent Brands and Sustainability Themes

Exhibit 10 - Incumbent Brands and Greenfield D2C Play

But there are a few differences though between such direct selling businesses and brands that have come to signify the D2C surge in India. The evolution of D2C story manifests the extent of the seeding of digital transformation that has happened in the country. D2C brands encapsulates this evolution almost in its entirety. Their advent was the result of the maturing of E-commerce value chain that allowed scores of D2C start-ups to start their own website, listing on marketplaces and App, direct ordering through technology enablement and establish digitally enabled consumer connect to seek insights for stickiness. Therefore, it is more appropriate to refer such D2C businesses as “digital first brands”

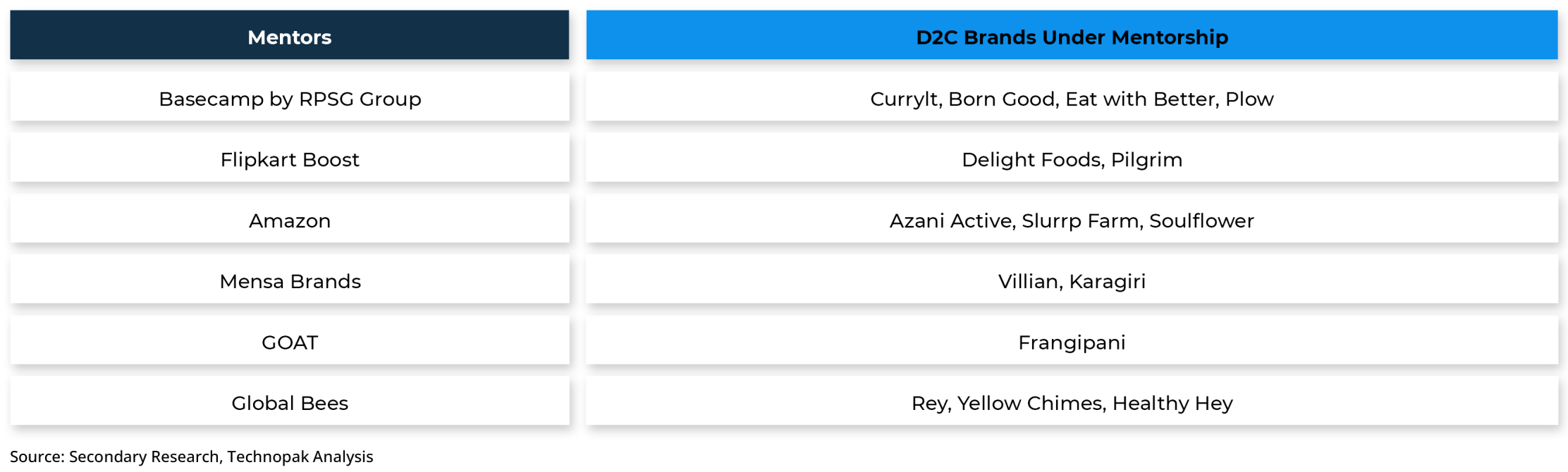

In some cases, aggregators acquire D2C brands and help them grow in the home market and overseas whereas some accelerator program can be limited to a one-time grant. The presence of multiple accelerator initiative is also an indicator that D2C brands is an important scalable opportunity. The advent of brand aggregator points to the direction of proliferation of D2C brands and there is market for specialized and integrated services to these D2C brands. However, brand aggregators are a new phenomenon which is yet to prove its worth by scaling up D2C brands. We look forward to these brands moving from first stage of Zoom to Break out stage.

D2C Brands now have access to D2C brand accelerators programs. This is different from plug and play facilities as aggregators can provide end-to-end support covering planning, advertising, cataloguing, logistics, quality control and mentoring to upcoming brand by providing them relevant mentoring that covers access to a network of investors, market intelligence, scalability programs, and relevant marketing engagements. D2C brands leverage expertise of accelerator programs across functions with value-driven business insights, digital visibility, and geographical expansion.

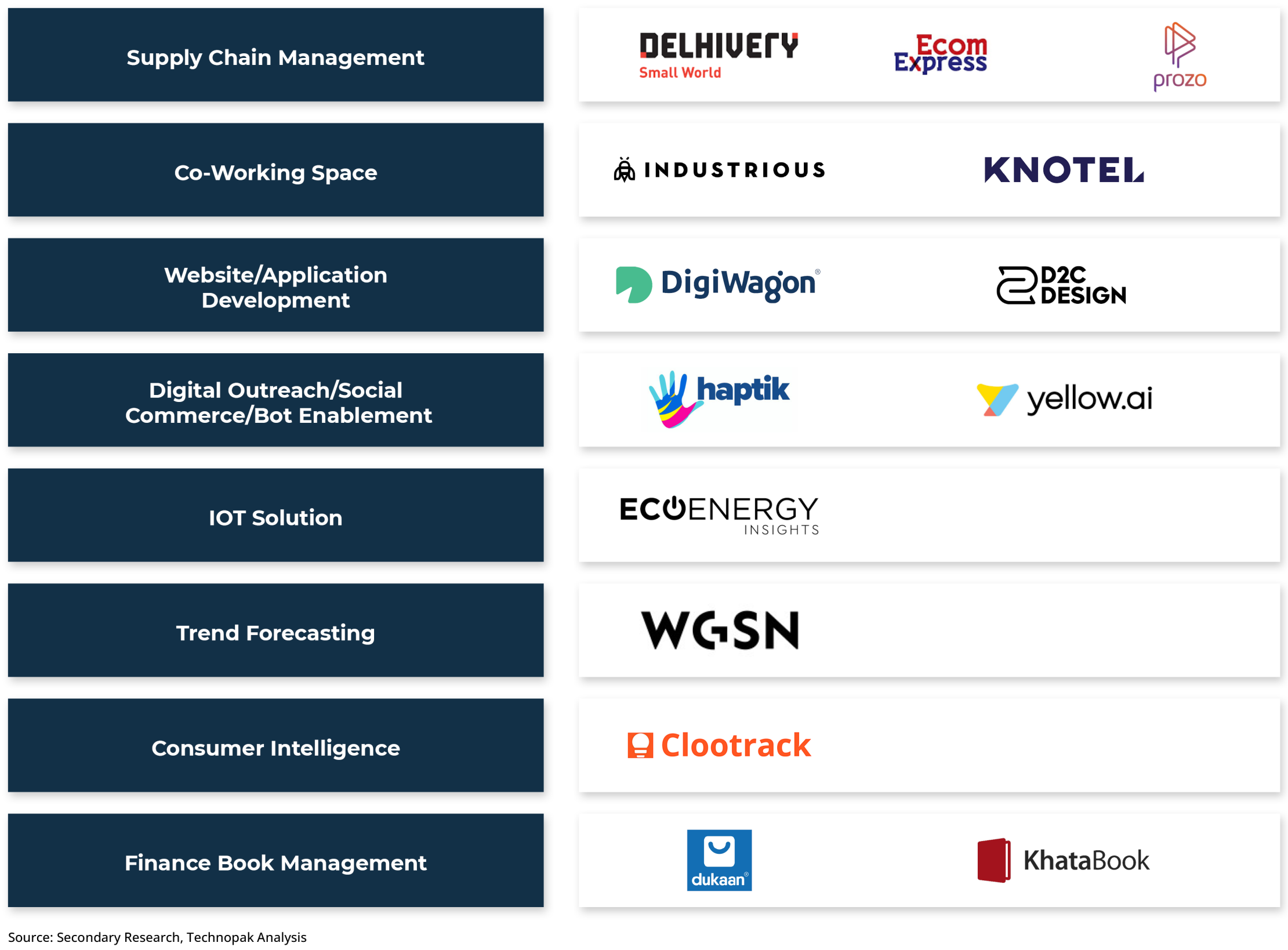

D2C brands are also benefiting for new age marketing channels and influencer marketing is cost effective as well sustainable as compared to traditional channels. There is an ecosystem of service providers with value addition across a range of services from marketing, insight generation, sales channel design and final delivery to the customer. There is a range of service providers for support functions from working space to financial accounts book- keeping which help D2C brands to focus their energy and creativity on customer needs and customer segment niches.

D2C brands today do not have to struggle with unit economics which can help service their customer base in cost effective manner. Third party delivery providers are making it possible to deliver at 27,000 pin codes in India with a tech enabled warehousing and transportation network. Also new age distributors are now aggregating brands and providing a shared plug and play sales and distribution service. Along with delivery models, payment models have matured reducing overheads with lower reliance on cash on delivery and lower failed transactions.

The growth of D2C brands in India is also a reflection of maturing eco system that provides a plug and play enablement for D2C brands to hit the market with convenience and efficiency. Today these plug and play solutions offer be-spoke services that reduces fixed cost and time to market for D2C brands. Even a decade back this was not the case in point and therefore the growth of D2C brands should also be read synonymously with maturing eco system that enables it.

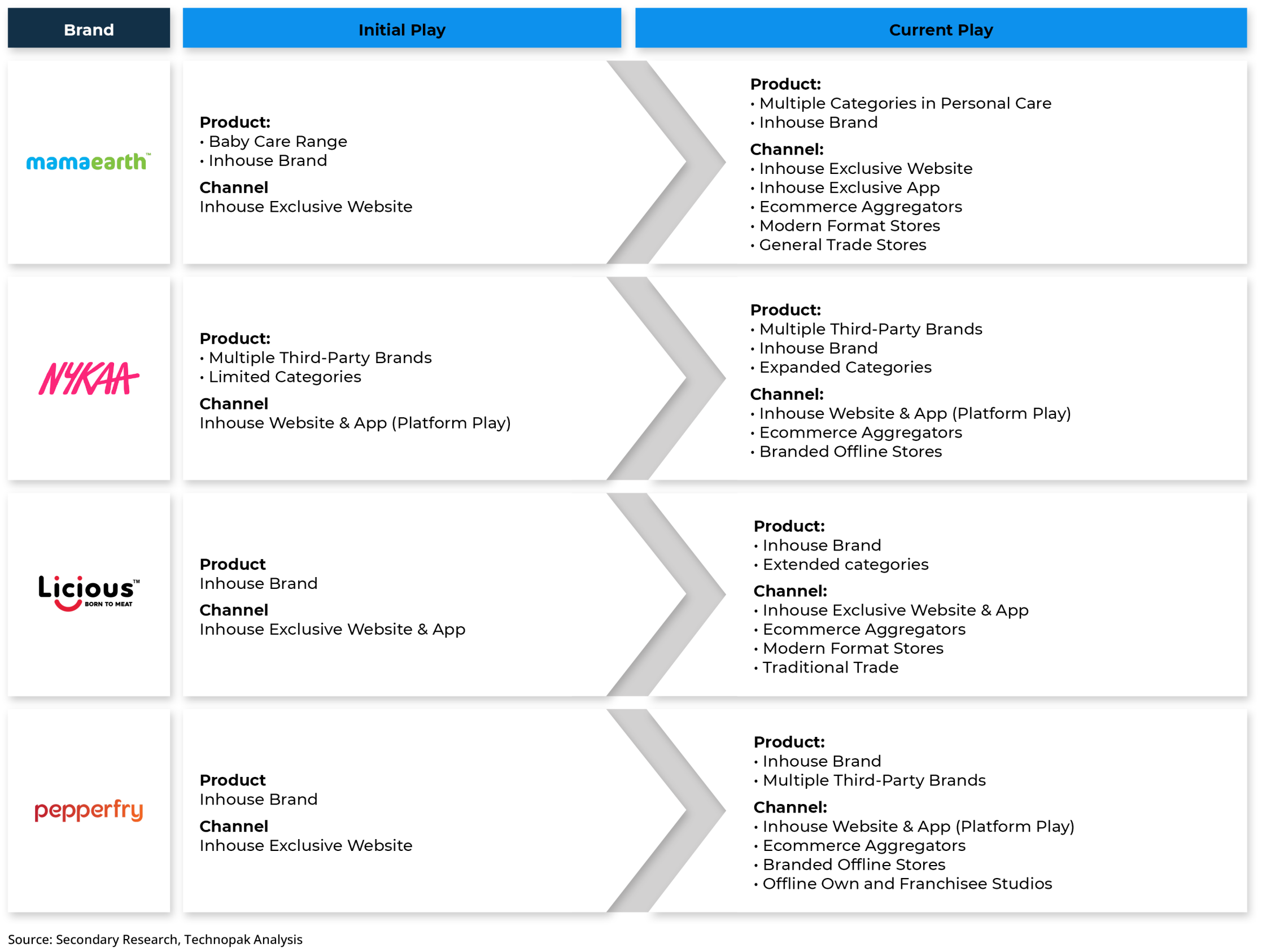

It is challenging to “templatize” D2C brands in a framework as they may appear to be shifty and seem to exercise all options on the table. There are vertical specialists selling own product through their own e-commerce platforms like Licious and there are multi-channel retail brands selling through both distributors and e-commerce marketplaces like Mamaearth. D2C brands display modularity that help them to rapidly change their form in response to market and consumer needs, opportunity to build scale, increase brand awareness and capture new niches.

In most cases, where D2C brands have achieved a certain scale, their current state appears to be vastly different from their respective starting point and this current state may itself change going forward. Instead of passing a value judgement about this shifty behaviour, we think of this trait as modularity that is hardwired in the D2C playbook.

Direct-to-Consumer is more a soft wired pitch of D2C brands and not a rule cast in stone. D2C brands today stand for multiple approaches to connect with customers and not limited to an exclusive direct to consumer website or application arrangement. Surely, D2C brands are digital first (and therefore digitally native) than the rest, but these D2C brands as they achieve scale rapidly shift from their respective starting points. On the face of it, these shifts appear to signify lack of focus or strategy, but we think of such shifts of these D2C brands as an advantage of no legacy cost that prevents legacy businesses to evolve and capture scale.

In this context three key attributes make these D2C businesses stand out from the rest

D2C, an acronym that stands for “Direct To Consumer” has gained immense prominence in the last few years, signify brands’ direct outreach to the consumer to sell its merchandise. However, on this count many direct to consumer selling businesses like Modicare and Amway that conduct direct consumer outreach through sales agents can stake claims to be D2C businesses and have done equally well.

This will not be a wrong claim.

Climate change is now arguably among the most important themes that businesses now consider for “future proofing” their existence. While climate change is a broad theme and is interpreted across sectors differently, for merchandise consumer brands the issue of circularity and reduced carbon footprint is increasingly taking centre-stage. Simplistically, this implies extended responsibility (EPR) of the consumer brand to take ownership of post consumption lifecycle of the product (viz. product packaging) and use of material in product design that increases circularity. The regulatory environment towards these issues that has shifted its gears from seeking voluntary actions to hard mandates.

In this backdrop, we have witnessed Incumbent brands to rapidly increase their commitment to re-usability, recyclability, and climate friendly products. But such commitments demand course correction from their existing arrangements (entails legacy costs) for the incumbents. We believe that D2C brands have no such compulsion that should strive to embrace sustainability and circularity from the start. While there are sporadic examples of D2C brands initiating their sustainability journey, we think given the clean slate advantage that D2C brands have, sustainability should be hardwired in their growth story. D2C brands have the advantage to create product stories around it and build supply chains that account for its costs and in doing so D2C brands’ embracing sustainability will not be an exercise in retrofitting but an in-sync growth story.

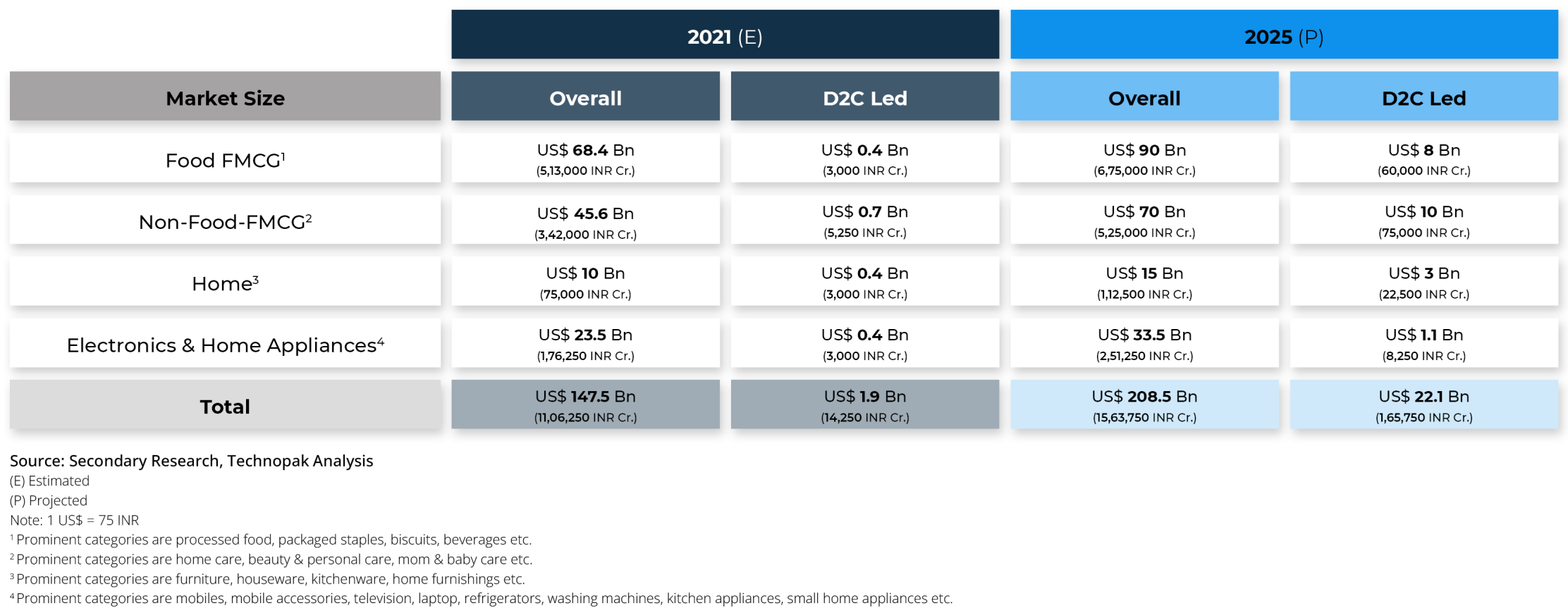

D2C led market is estimated at ~ $ 1.9 billion contributing close to 1% of Indian FMCG, home market & consumer accessories market, involving 600 D2C led brands/businesses. More importantly, D2C market size is estimated to grow to $ 22 billion by FY 25 and will contribute more than 10% to the total FMCG, home and consumer accessories market.

This paper attempts to answers these questions in the hope that it provokes the reader and offers her enough food for thought. The paper begins by sizing the D2C space in India and then proceeds to sketch out key differences that exist in the character of a D2C business when compared with that to an incumbent business. It presents key trends that are shaping the D2C businesses in India and growth imperative that the paper believes is necessary to be kept in mind for those with stakes in such a business.

If at the end of the day products sold are speakers, lotions, condiments, and sauces, how is then a D2C business different for any usual business that has been selling the same products for long? If, there exist any difference/s between a D2C, and a legacy business then how should D2C businesses be evaluated and what kind of frameworks will we need to assess them?

Arguably, D2C has made the most sizzling debut in the business lexicon in the recent past. In a short span of not exceeding five years, D2C has come to signify stellar public market debut of brands like Nykaa, private equity’s preferred theme to bet on in India in the private consumption space, incumbents’ acquisition sprees, heroic stories of grit, digital marketing antics and a lot more.

The D2C brands do not incur legacy costs like incumbents do. Such legacy costs comprise myriad aspects that incumbents need to provision for, while navigating change and building scale over time. These costs can encompass factors across the value chain including packaging, raw materials, technology systems, organization structure among others. Incumbents always confront the challenge to change and account for the new realties that impact their value chains and one such reality is the rising concern around sustainability.

Exhibit 09 - Incumbent Brands and Brownfield D2C Play

Exhibit 08 - D2C Brand Aggregators and Co-Opted Brands

Exhibit 07 - Plug and Play Ecosystem for D2C Brands

Exhibit 06 - D2C Brands Transition

Exhibit 05 - Transition of D2C Brands

Exhibit 04 - D2C Brands Market Sizing and Growth Projection

Exhibit 03 - D2C Brands and Incumbent Brands

Exhibit 02 - D2C Brands Fact Check

Exhibit 01 - D2C Brands Market Sizing and Growth Projection

This custom report prepared by Technopak Advisors Private Limited (herein after “Technopak”). The information and content within this report is for general information purposes only and is derived from primary and secondary research data which have been relied upon while preparing the report.

However, no representation or warranty (expressed or implied) is made nor is any responsibility of any kind accepted with respect to the completeness or accuracy of any information as may be contained herein. Also, no representation or warranty (expressed or implied) is made that such information remains unchanged in any respect as of any date or dates after those states herein with respect to any matter concerning any statement made in this report.

This report and the information contained herein may not be disclosed, reproduced, copied, or shared in whole or in part with anyone. Technopak is not responsible for any action or inaction that is taken basis the contents furnished in the report and the report is provided on as ‘AS IS’ basis without a guarantee for meeting a particular purpose.

Technopak, and its directors, employees, agents and consultants shall have no liability (including liability to any person by reason of negligence or negligent misstatement) for any unauthorized disclosure, statements, opinions, information or matters (expressed or implied) arising out of, contained in or derived from, or of any omission in the information package and any liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this report and/or further communication in relation to this report. Recipient of this report should not use or communicate information contained in the report in contravention of applicable law and this important notice.

Breakout

Climber

Zoom

Break out D2C brands are almost indistinguishable for incumbent brands for their product offering, size of the organization, brand equity and size of business, though it does not imply a steady state for them. They may / may not be operationally profitable but display a path of continued growth (and a leading market position) to the investors. The operational team comprise professionals and show a stable and a cohesive existence. Brand equity stands out for consumers’ recall, technology and data focus and with founders’ synonymity. Business focus demands product de-risking, profitability, mergers & acquisitions with a desire to mimic the incumbents with certainty of cash flows and business outcomes.

This stage is signified by a period of significant organization transformation both enabled by external pressures and by internal reflections. The phase demands D2C to venture into new markets and / or activating new routes-to-market. Product offering is expanded to broaden the appeal. Business focus on expanding the product basket, creating efficiencies in supply chain and acquiring new consumers are the order of the day. Internally organization starts to pivot towards formal set-up comprising professionals and specialized skills. The organization embarks on experimentations but many of them face headwinds and failures. Product offerings increase significantly and so does the organization’s complexity in terms of teams, reporting relationships and conflicts. Scaling up offer development, data analytics and growth of new consumer base are key focus areas that demand leaderships’ attention. The pace of growth slows down as compared to the one observed in the Zoom phase. It is a slow climb that requires focus on right set of areas to stay the course.

This stage is signified by the strength of that one idea that finds its consumers in reasonably large numbers and enables the D2C business to achieve an annual sales rate of Rs 50 crores. It is signified by D2C’s success to create a direct retail access to a captive consumer base with most of the sales (80% or more) coming from these captive consumers. This is an important milestone in journey of D2C brand where the strength of idea is proven in the form of product niche. The founder team (or individual) play an active role demonstrating tremendous dexterity across functions and double up as a de-facto lead on all key decisions. No rule is carved in stone and any or all options are exercised to drive both consumer stickiness (measured as repeat business) and new consumer acquisition during this phase.